2017 was another good year for e-commerce, with online sales in 2017 growing globally by 23 percent and in the United States by 15 percent. Online sales also accounted for 12.9 percent of total retail sales in 2017. There’s a lot we can learn from the past year that will help us shape our predictions for the year ahead.

Notable 2017 initiatives

There were number of initiatives last year that will have an impact in the coming years, including:

Changing retail environment

With 6,985 announced store closures in the U.S., traditional brick-and-mortar retailers are adapting to a new reality:

- Underperforming stores are being closed but those retailers are also seeing increased revenue from their online sales. Here’s what we can learn from recent retail closures.

- It’s also necessary to point out the more than 3,000 announced store openings in 2017. There’s a lot to consider if you operate (or are thinking about opening) a brick-and-mortar store and how you can best use the space to boost your omnichannel experience—read more here.

Amazon’s increasing dominance

Amazon had another good year, grabbing an estimated 44 percent of online sales in the U.S. The success was heavily driven by its loyalty program, with Amazon Prime (now available in 16 countries) shipping over 5 billion items in 2017.

Walmart racing to catch up

Walmart’s U.S. e-commerce sales grew by over 50 percent per quarter in the first three quarters of 2017. Customers can now purchase one of the 67 million items available from over 5,000 merchants that are now part of the marketplace. Walmart also increased its younger customer base by acquiring Bonobos, Modcloth, Moosejaw, Shoebuy and Shoes.com. Including acquisition of Jet.com, Walmart has spent over $3.5 billion between August 2016 and June 2017and it may not be over.

Expedited delivery through consolidation of the market

Acquisitions that occurred in 2017 can help us understand how 2018 is going to look, and namely:

- Large retailers acquiring same-day delivery companies—One example is Target’s acquisition of Grand Junction, a transportation technology company that provides a software platform to manage local deliveries of more than 700 carriers. There’s also Walmart’s purchase of Parcel, a company specializing in same-day delivery of groceries and meal kits.

- Carriers also extending same-day deliveries—FedEx announced in October that its FedEx SameDay City service is now offered in 1,800 cities in 30 regional markets. Deliv, where UPS has shares, is available in 1,400 cities in 33 markets.

- Fulfillment services—With Amazon Prime growth combined with Fulfilled by Amazon (FBA), other players have started to look into fulfillment services. Belgian postal operator bpost announced in October its acquisition of Radial, which has 24 fulfillment centers, and there is also some speculation that eBay and Walmart may offer FBA-type solutions to its merchants.

2018 predictions

With all that happened last year what can we learn for the coming year? Here are a few e-commerce and shipping predictions for the year ahead.

1. Increase in Amazon Prime-type programs

According to a SmarterHQ report, 82 percent of Amazon Prime members would cancel their membership without free two-day shipping. This seems to be a new norm, which is why you can expect other online merchants to kick off loyalty programs with similar shipping conditions. For example, German fashion retailer Zalando has already launched a loyalty program called Zalando Zet, with which its members get various benefits including faster delivery, on-demand returns pickups, earlier access to deals and even personal fashion advice.

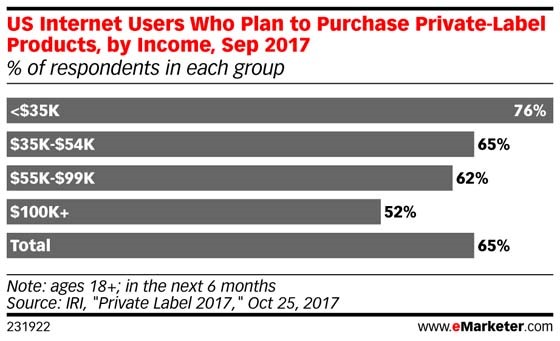

2. Retailers will invest more in private labels

Historically private labels were bought by lower-income customers, but a recent IRI survey found that over half of consumers with household income of more than $100,000 expect to buy more private-label items.

One example of the growing popularity of private label items is Brandless, a new online retailer selling generic household goods like pasta sauce and cleaning products for $3 per item. The new startup has raised $50 million in funding from investors thus far.

3. Brands will shift more sales to marketplaces

With the rise of private labels offered by retailers and the increased role of marketplaces, many brands and manufacturers may shift more sales directly to marketplaces. Nike, for example, started offering its products on Amazon in 2017.

4. Understanding customers by utilizing Big Data

Online merchants will further invest in understanding their customers. E-commerce managers will invest in content marketing, big data and machine learning to understand what their customers want in more detail. Customer retention through loyalty programs will be on the rise.

5. Voice commerce is the new mobile?

Adyen stats show that mobile’s share of sales has reached 52 percent, surpassing desktop as the technology of choice for e-commerce purchases. For years, we have been hearing about mobile commerce and now it seems that this is now a norm.

2017 was a year where voice-enabled commerce started to gain traction. Alexa, heavily promoted by Amazon with discounted offers during Prime Day and Black Friday/Cyber Monday weekend, mostly drove this. Other solutions are Home by Google, Siri by Apple and Cortana by Microsoft. Also, Walmart is cooperating with Google to enter the field of voice-enabled commerce.

Let’s see what the future brings. Definitely, many fascinating new developments will shape the e-commerce space.

About Endicia

Endicia is a leading provider of internet-based postage services that make it easier and more affordable to ship parcels through the U.S. Postal Service®. We know that shipping can be complex and our goal is to simplify your shipping operations so you can focus on doing what you do best. Visit us at endicia.com to learn more.