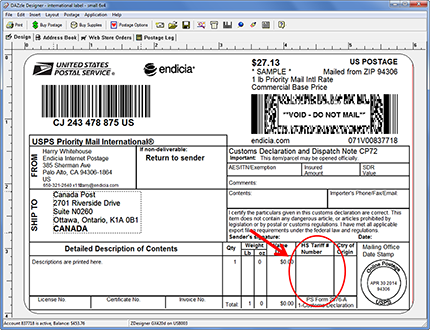

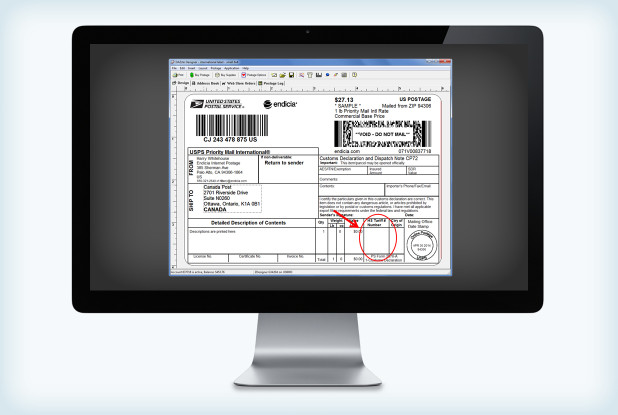

To most new ecommerce business owners, the Harmonized Tariff number field is the scary optional field (see below) that they avoid whenever they need to ship something out internationally with the U.S. Postal Service®. Others avoid this section with the hope of escaping duties and taxes levied by importing governments.

Click image to see a larger version

you’ve been leaving the HS Tariff number field blank, you might actually be doing yourself more harm than good. Why? Well, this section is actually one of the most important fields on the customs form for USPS® international shipping. Let’s talk through some of the possible scenarios that may occur if you don’t classify your products:

- Delays: Non-classification could lead to delivery delays, since importing governments will be forced to classify your export manually.

- Denials: Each importing government has its own unique restrictions in place to protect local markets. While there are some products that are perfectly fine to export in one market, they might very well be denied in another.

- Returns: Did you tell your foreign buyer what the taxes could be? Depending on the importing market, the taxes could be very high. You shouldn’t assume that all foreign buyers are experts on their taxed items from the United States. Such surprises could result in returns that are billed back to you.

- Double taxation: Do you have a returns policy for international shipments? If not classified properly, your returns could be improperly double-taxed when returned to the United States.

How to Use the HS Tariff Number for Your Ecommerce Shipping:

Know your Destinations

Don’t assume that shipping your product to Canada means that you’ll be able to ship it to Brazil. Each country protects its domestic market in different ways, so it’s important to review the prohibitions and restrictions of each market before you enable shipments to those markets. The USPS provides a list of prohibitions and restrictions for each market. This is a good place to start before you enable your exports to certain markets.

Know Your Products

Now that you know where your product can be accepted internationally, it is important to classify your product. While researching the tariff, you need to familiarize yourself with the headings, notes and language of the tariff. Compare numbers at the same rank or hierarchy. When doing so, you must select the four-digit heading first and then move on to selecting the subheading and U.S. classifications. Use explanatory notes published by the World Customs Organization for insight into the six-digit level of the tariff. You can research binding rulings on government sources or third-party databases.

Be Upfront With Your Customers

Once you obtain your tariff code, you’ll be able to calculate the full cost of your transaction for your foreign buyer. It is important to calculate any duties, taxes or other fees levied by importing governments. Then you can present the total cost to your foreign buyer in advance of order confirmation to ensure that there are no surprises or misunderstandings about the true cost of the order.

DDP or DDU

DDP refers to “delivered duty paid,” while DDU refers to “delivered duty unpaid.” In other words, do you want to pay the taxes in advance on behalf of your buyer, or do you want the buyer to be responsible for the payment of duties and taxes?

It is important to be aware of the differences between DDP and DDU. Typically, most items delivered through USPS shipping services fall within the DDU flow. One of the advantages of shipments by DDU is that not all items are assessed for duties and taxes in this flow, whereas all items under DDP are assessed for duties and taxes. In some markets, fewer than 25 percent of items exported are levied taxes by the importing government in the DDU flow. Either way, it is still important to research the taxes and present the cost estimate to buyers in advance (whether or not they are taxed).

Plan for Returns

We all know that it is critical to have a returns policy in the U.S. market, but did you know that it is also important to have a returns policy for foreign markets? Foreign buyers’ demands are following U.S. trends, and it is important to have a clear policy in place for your foreign buyers. As an example, 59 percent of Canadians expressed concerns about restrictive returns policies from U.S.-based merchants. So, if your policy includes a return back to the United States, make sure you are using a solution that distinguishes the return from normal U.S. imports. At Endicia, we offer a returns solution that creates a special label for the return with default tariff codes and markings specifically for returned goods to ensure that items are not double-taxed on the return.